This is a continuation of our series "How Companies Can Build Context-Aware Chatbots with Their Own Data"

Before diving into implementation, it is important to strategize how to optimize your generative AI system for your specific business needs.

Key considerations include:

- Security and Privacy - How secure does data need to be? For really sensitive data, you may want custom systems instead of vendor cloud services. Strict controls on access and following rules are critical.

- Performance - Should data be separated to work better? Do you need real-time updates or are batched updates ok? Caching and limiting traffic can help manage use.

- Design - Will open source or bought solutions be easier long-term? Can APIs from other companies provide needed features instead of building custom? A mix of both balances control and convenience.

- Monitoring - How will you track performance, issues, and use? This is key for optimizing ongoing costs, reliability and user experience.

- Integration - What blend of custom programming vs automation platforms is best? Low-code tools speed up workflows while custom code allows closer optimization.

- Prompts - How will you guide the chatbot's behaviors to meet business goals? Testing prompts, libraries, and feedback loops maximize value.

- User Interface - Use default conversation interfaces or custom ones? Smooth user experiences and feedback systems increase adoption.

By reviewing unique needs in these areas, engineers can strategically design an AI system matched to specific business needs. Thoughtful planning provides the blueprint for building an optimized system.

Overview of key steps to implement the finance chatbot:

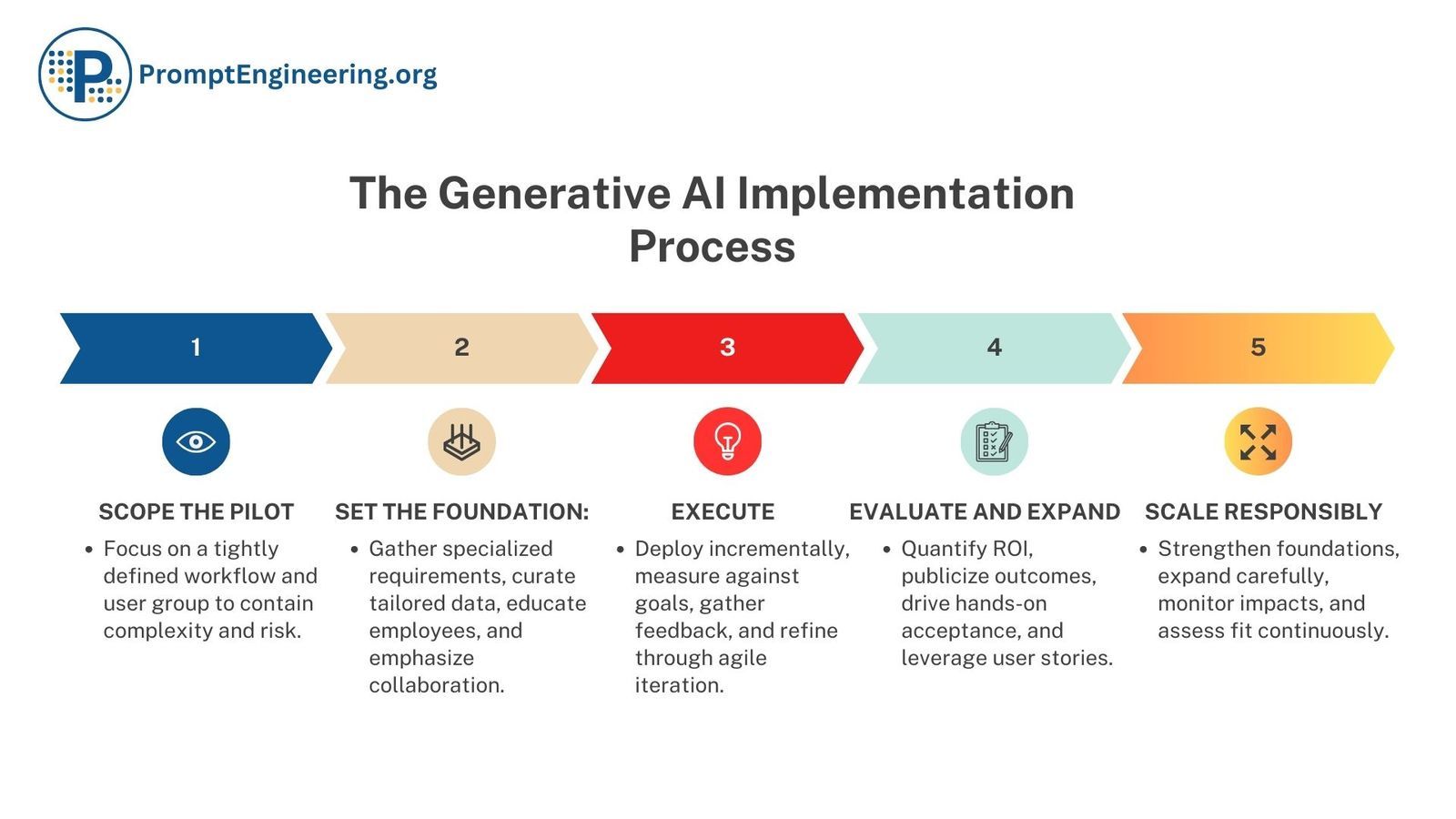

We will use our 5-step GenAI implementation process, outlined here, to go through the entire process.

\

We will use our 5 step process to go through everything:

1 - Limit the pilot:

- Focus on one workflow like monthly reporting

- Choose a familiar, structured process for one team

- Limit to that team first to avoid complexity

2 - Build the foundation:

- Get specialized requirements from the finance team

- Collect relevant example data

- Educate employees a lot on AI

- Emphasize AI assists, not replaces, people

3 - Run the pilot:

- Start limited deployment with the finance team

- Measure against goals and get user feedback

- Improve through fast iteration before expanding

4 - Review and expand:

- Quantify ROI like cost and time savings

- Promote results and user stories company-wide

- Drive adoption by slowly expanding access

5 - Scale responsibly:

- Prioritize data, training, prompts for the use case

- Carefully expand capabilities on solid foundations

- Take a controlled approach to scaling

This phased approach focused on managing change, getting user feedback, and iterative improvements ensures responsible AI adoption that improves workflows and assists human roles.

1 - Scope the Pilot

For the initial pilot, we will focus the financial chatbot on supporting executive decisions about entering new markets or launching new products.

Focus on One Workflow:

The chatbot will target the specific workflow of gathering data and inputs to evaluate a potential new market entry. This includes aggregating historical accounting data, analyzing the latest market data, and enabling executive discussions. Rather than attempting to automate post-launch activities upfront, we'll focus just on the pre-decision analysis phase.

Pick a Structured Process:

While each potential new market decision is unique, the high-level process for gathering inputs is structured. Steps like consolidating accounting data, extracting market intelligence, and facilitating executive meetings to discuss findings follow a standardized workflow. Optimizing the chatbot for data aggregation and meeting support provides clear value.

Contain Scope:

We will limit pilot participants to the core team involved in new market entry decisions - key finance leaders, department heads, and the executive strategy team. This focuses on training on their specialized data needs, terminology, and decision protocols. Avoiding wide access reduces variables as we tailor the chatbot to their workflow.

This concentrated scope enables us to:

- Narrows the focus to optimize for a specific use case: streamlining monthly financial reporting for finance users.

- Simplifies integration needs by limiting required data sources and permissions.

- Streamline required accounting, market data, and meeting inputs

- Establish clear success metrics around data aggregation and meeting efficiency

- Reduce risk of overextending capabilities too soon

- Provides a contained environment to refine FinBot's capabilities based on quantified metrics and feedback.

- Reduces disruption by only impacting the finance department during the initial rollout.

- Limits variables to mitigate risk and increase the likelihood of clear pilot success.

The controlled pilot will allow us to demonstrate the chatbot's value for consolidating inputs and facilitating executive decisions on new market entry. We can then expand its capabilities to additional decision workflows.

2 - Set the Foundation

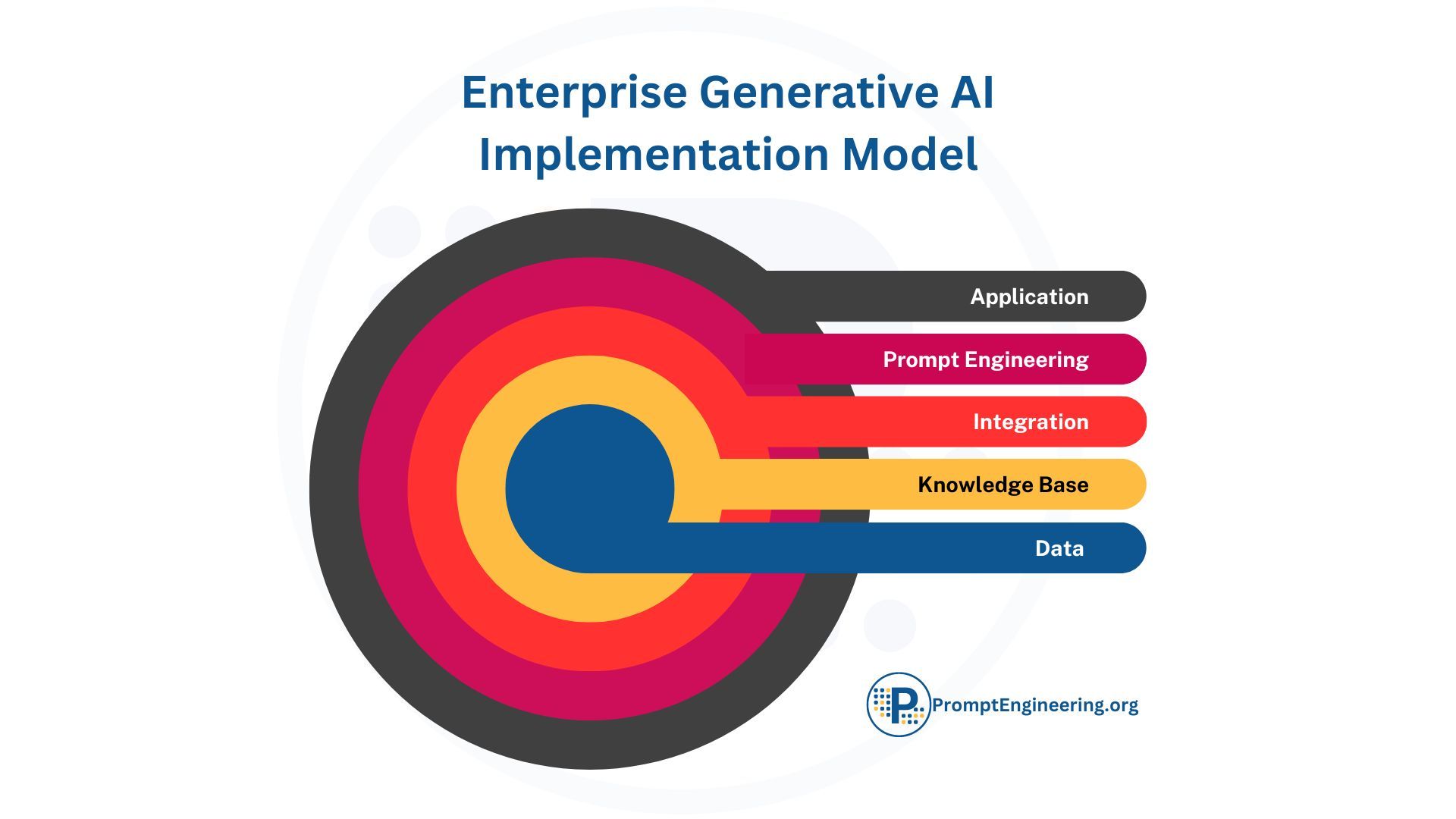

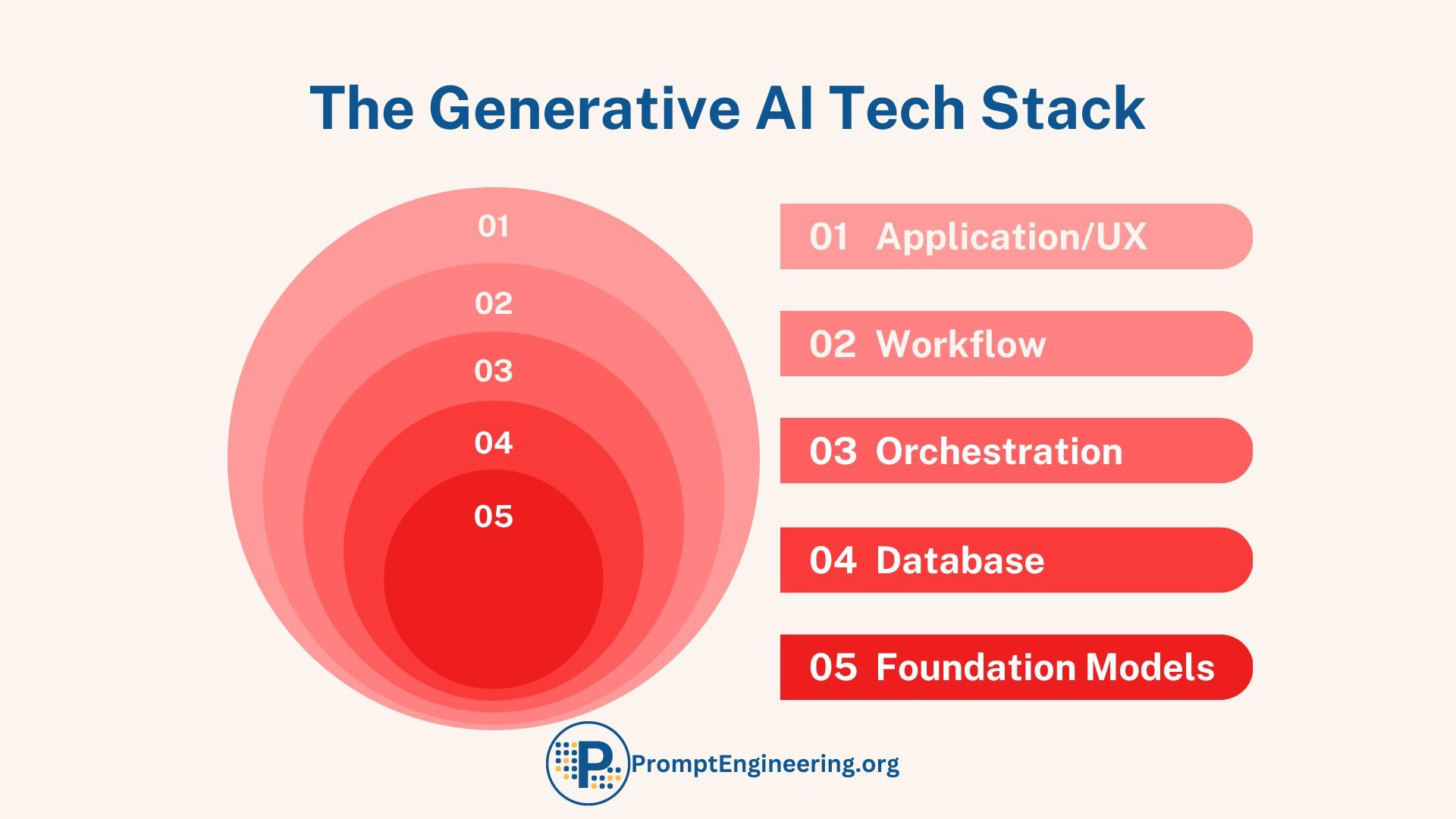

At this point, there are 2 Frameworks we will leverage:

- The Enterprise GenAI Implementation Model - this will assist us in our logical implementation

- The Generative AI Stack - this is the tech stack that will guide our technological implementation

With the pilot scoped to the new market entry workflow, we will focus on establishing the right foundation:

Gather Specialized Requirements

We'll meet with the core executive strategy team to understand their goals, priorities and pain points for evaluating potential new markets. This will identify the key data inputs, analysis, and meeting support they need to make informed expansion decisions.

Tailoring requirements gathering to the pilot group's specialized workflow prevents misalignment and allows us to optimize the chatbot for their use case.

Curate Relevant Data

Based on the requirements, we will curate a dataset specific to new market decisions:

- Historical accounting data for current operations and past expansions

- Market research data on trends, competitors, and customer demand signals

- Examples of past presentations, memos, and meeting minutes associated with new market evaluations

- Requirements align FinBot to their specialized reporting process and goals.

- Curated data improves model relevance to their work environment.

- Extensive training builds AI literacy and capability.

- Positioning as a collaborator counters automation fears.

This provides targeted, quality examples for training.

Educate Employees Extensively

Before pilot launch, we will provide training on AI technology and best practices to involved teams and the organization broadly. This establishes understanding and counters misconceptions.

Emphasize Collaboration

Our messaging will reinforce that the chatbot aims to enhance human decision-making, not replace it. We will be transparent about plans to support any displaced employees. Positioning the technology as a collaborator builds trust.

This tailored foundation fortifies the chatbot's capabilities while securing buy-in from pilot participants. With specialized data and extensive education, we can transform the new market entry process.

3 - Execute the Pilot

With the foundations in place, executing the focused pilot involves:

Deploy to the Finance Team: Roll out FinBot solely to the finance department for a contained trial period. This limits exposure and enables specialized feedback.

Measure Against Goals: Assess quantitative metrics like cost reductions along with qualitative goals like user satisfaction. Compare results to predefined success criteria.

Gather User Feedback: Collect detailed feedback through surveys, interviews, focus groups, and open communication channels. Gather insights on real user experiences.

Refine Through Iteration: Rapidly iterate FinBot based on user feedback and performance insights. Fix issues, meet new needs, refine prompts, and improve capabilities.

Concentrating the pilot on the target finance team:

- Allows gathering specialized feedback to optimize FinBot for their reporting use case.

- Focuses iterations on enhancing value specifically for the finance workflow before expanding.

- Isolates impact until the solution matures through real-world testing with the target users.

Specializing deployment and refinement establishes a proven model before gradually scaling to the broader organization.

4 - Evaluate and Expand

Once the new market entry pilot demonstrates success, we will work to strategically expand usage:

Quantify ROI

We will analyze performance metrics to quantify the chatbot's ROI including decision timeframes accelerated, reduced analysis costs, and improved productivity.

Publicize Outcomes

Leadership endorsements, case studies, and testimonials will promote the pilot outcomes cross-organizationally to drive receptivity.

Drive Acceptance

Rather than a full rollout, we will gradually expand access to new teams for controlled trial periods to drive hands-on adoption. For example, providing access to strategy analysts or regional executives first.

Leverage Stories

Early user testimonials will be incorporated into training and communications to inspire confidence in adopting the technology.

Additional Expansion Considerations:

- Start with a limited user group: Expand incrementally to gather ongoing feedback for refinement before full rollout.

- Expand training data: Enhance accuracy by growing the dataset breadth and depth.

- Improve conversational ability: Identify and improve struggled areas through focused feedback-driven training.

- Widen question domains: Expand the chatbot's capabilities while limiting initial complexity.

- Test new features: Pilot top requested capabilities like alerts and scenario comparisons.

- Increase access points: Allow mobile access to integrate with workflows.

- Monitor closely: Continue rigorous measurement and user feedback analysis.

This phased, user-centered strategy will smooth the path to organization-wide adoption.

5 - Scale Responsibly

As FinBot expands, we will scale capabilities strategically:

Optimize the Foundation: Prioritize improving FinBot's core data, training, prompts, and reliability rather than chasing new features. A strong foundation sustains performance.

Expand Gradually: Move slowly in applying FinBot to new teams, with incremental additions focused on replicating the finance use case. Controlled growth allows scaling expertise and support.

Assess Continuous Fit: Regularly check performance metrics, user feedback, and usage trends to address issues proactively before small problems worsen.

Consider Unintended Impacts: Study broader influences on employees, customers, and society as adoption spreads. Audit for biases and plan mitigations.

Responsible scaling practices:

- Maintain FinBot's fundamentals before expanding functionality to prevent regression.

- Incrementally integrate new use cases to build competency before rushing ahead.

- Continuously monitor leading indicators to stay ahead of issues.

- Proactively identify and address wider impacts of increased automation.

This measured approach to scaling reinforces FinBot's foundations while allowing supportive resources, governance, and organizational capabilities to mature in parallel. Prioritizing responsibility builds trust and sustained success.

The Roles Needed for Successful Enterprise GenAI Deployment

1. The Chief AI Officer's Role

As our first CAIO, this executive will be critical for driving the adoption and success of FinBot across the organization. Key responsibilities include:

- Formulating an AI strategy aligned to business goals and identifying high-value use cases like FinBot. This involves integrating AI horizontally.

- Constant learning about AI developments and understanding their applications to the company's financial processes. The CAIO must stay on top of a rapidly changing field.

- Blending business needs and technological capabilities to ensure FinBot and future AI solutions are tailored to enhance financial operations and deliver insights.

- Advocating for AI adoption by educating departments on how FinBot can augment capabilities and productivity for finance workflows. The CAIO must counter scepticism.

- Forging their career path and progression without defined prerequisites for the unprecedented CAIO role. Ambiguity and learning on the job will be par for the course.

Critical attributes for our CAIO include passion, flexibility, learning ability, multidisciplinary experience, and cultural fit. Expertise in prompt engineering generative AI models is also vital to overseeing FinBot's design and driving adoption.

With the right intrinsic qualities and AI knowledge, our pioneering CAIO can navigate uncertainty and transformational change to spearhead our AI-powered future. Their leadership will be indispensable.